Our goal is to share information and products that are truly helpful to renters.

If you click on a link or buy a product from one of the partners on our site, we get paid a little bit for making the introduction. This means we might feature certain partners sooner, more frequently, or more prominently in our articles, but we’ll always make sure you have a good set of options. This is how we are able to provide you with the content and features for free. Our partners cannot pay us to guarantee favorable reviews of their products or services — and our opinions and advice are our own based on research and input from renters like you. Here is a list of our partners.

Can a rent assistance program help me?

Learn about nonprofit, state, and federal rent-assistance programs

Many nonprofit agencies, faith-based organizations, and government programs provide one-time emergency grants to help with rent before you get too far behind and risk eviction. Typically, rent assistance grants range between $750 and $1200. And because they’re a grant and not a loan, you don’t have to pay them back. Assistance can give you the buffer you need to get back on track in the short term. If you need longer-term help, the federal government offers subsidized housing and voucher programs. (More on that later).

Help with rent: Community nonprofit organizations

Local nonprofit groups like 211.org (a nationwide program provided by United Way), Modest Needs, and county-by-county veterans’ assistance programs can connect you to rent resources and grant money. Each nonprofit will have its own criteria. Some are available only if you live just above the poverty line. Other organizations support groups such as veterans, teachers, or first responders. While some programs provide ongoing help, others offer one-time emergency grants only. (Use the search tool at the top of the page to find out what’s available in your area).

Help with rent: Faith-based organizations

Many faith-based organizations offer financial assistance to cover rent and other living expenses. Usually, this assistance is available to members of the community, not just to members of their congregation. They rarely turn someone away who’s struggling. Many faith-based organizations also provide job preparation services, immigrant support, parenting education, and counseling. They also tend to be well-versed in government programs and can help connect you to additional services. In addition to what might be available locally, a number of larger faith-based organizations have a national presence and programs:

- The Salvation Army

- Catholic Charities

- Jewish Federation of North America

- Episcopal Church

- Lutheran Social Services

- Love, Inc.

- United Methodist Church

- St. Vincent de Paul Catholic Church

Help with rent: State and city governments

All states and most city governments have assistance programs. These are designed to help you pay rent, utilities, security deposits, storage fees, and other housing expenses. Their goal is to reduce homelessness in the community and provide grants for struggling renters within a specific county, city, or town.

Most state and city rent-assistance programs will require that you have a job or income source to pay rent, as their grants are intended for one-time emergency support. Some programs will work with you to create a budget or set goals to help stabilize your housing. You can start by contacting 211.org for a referral or your state housing financing agency.

Help with rent: Federal government programs

Government-subsidized or voucher programs may be able to offer long-term rent assistance. They generally support struggling seniors, veterans, working families, and people with disabilities. The trick here is also that there’s limited funding. You may have a hard time getting the help you need — only one in four households who need help get it — so get familiar with “HUD” requirements and be persistent.

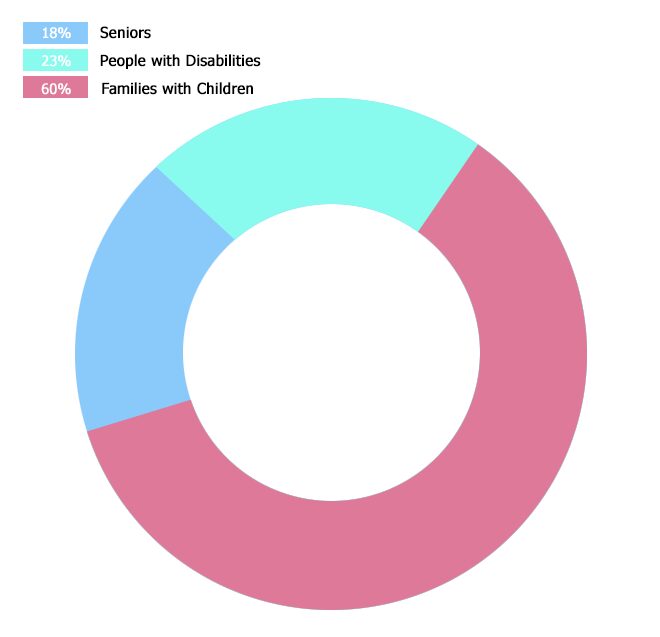

Who gets Federal Rent Assistance?

| 18% | 23% | 60% |

| Seniors | People with disabilities | Families with children |

What is HUD and what programs do they offer?

The U.S. Department of Housing and Urban Development (HUD) provides ongoing rent assistance by funneling money to state and local public agencies. The intent and design of their programs vary.

Here are the most common HUD programs and important details about eligibility and timing:

Public housing

Public housing is federally subsidized rental property. Depending on where you live, subsidized housing may be an apartment complex, a series of duplex houses, or a cluster of private homes. Local housing authorities manage the rentals, and they determine how much you pay in rent according to HUD guidelines — at least $25, and at most 30% of your monthly income. To apply, contact a public housing agency.

Privately-owned subsidized housing

If you can’t afford to wait for subsidized housing, explore the privately-owned route. These housing complexes, also known as “mixed-income housing,” are owned by private landlords and property management companies. In exchange for a tax credit, they’re required to offer at least some of their apartments at a reduced rate to low-income families. They look similar to other apartment complexes. How much rent you pay depends upon various factors — generally, the less you earn, the less you pay. Some landlords offer a flat rate for anyone who qualifies, while other landlords base your rent on your monthly income. Search for an apartment and apply directly to the management office.

Rent Payment Assistance — Section 8

The Housing Voucher Program, also known as Section 8, is different from subsidized housing and gives you more freedom where you can live. Using this program, you’ll receive a voucher that you can use to rent from private landlords and apartment properties — any landlord on the approved Housing Voucher Program’s list.

With Section 8, you pay a part of your rent, about 30% of your monthly income, and the local public housing authority pays the rest (up to a certain amount based on market rent rates). To apply, contact a public housing agency.

Eligibility and wait times

To qualify for the Section 8 program, you can’t earn more than 50 percent of your area’s median income. For public housing, your wages can’t surpass 80 percent of the median.

Either way, preference is given to the homeless, people living in substandard housing and households that spend more than half of their salary on rent. Once you apply and are qualified, you’re added to a waitlist. In some areas, it takes more than a year to get housing. In areas with significant waitlists, it can take significantly longer.

How rent assistance programs work

Struggling with rent and housing is stressful, and unfortunately, getting help takes time. Fortunately, many faith-based, nonprofits and government organizations require similar types of documentation and the application processes tend to follow a similar path. So once you apply for one, the next application should get a little easier and faster. Here’s what to do and expect:

1. Figure out which programs you’re eligible for

Read through each program’s criteria as you may be more likely to qualify for one program than you are for another.

2. Gather your application materials

Most programs require a bunch of information so they can evaluate your situation and level of need. This typically includes financial, current housing information and some type of explanation:

- Copy of your lease

- Personal statement. Write down what you’re asking for and why. For example, “I need $500 for this month’s rent. I lost my job last month but I’m starting a new job in two weeks.”

- Social Security Number

- Government-issued photo identification

- Copy of your eviction notice

- Proof of financial hardship — change of employment status, illness, divorce

3. Register with the organization and apply

Many nonprofits won’t begin reviewing the application until all the required documents have been submitted. Make sure to set enough time aside to thoroughly complete your application.

4. Follow up with the agency to ask about your status

Some offer online status. Others you may need to call if you have not heard back within a few business days. Typically, each organization will provide you with guidance for response and how long the grant takes to get funded.

5. Be politely persistent

It’s hard to ask for help, and the process can be long and frustrating. Be organized and politely persistent to get the help you need.

If you need help right now and are at risk of homelessness

If you’re about to become evicted or on the verge of homelessness, contact a local support agency through the HUD exchange. Also consider calling the Legal Aid Society to help you get a payment extension, find a new home, or get an eviction blocked. The Legal Aid society gives you free professional help. It’s an independent nonprofit legal service provided by the government to help low-income families and individuals with eviction and other civil matters.

Your renters rights, in your state.

Explore what you need to know.

- Alabama Renters Rights

- Alaska Renters Rights

- Arizona Renters Rights

- Arkansas Renters Rights

- California Renters Rights

- Colorado Renters Rights

- Connecticut Renters Rights

- Delaware Renters Rights

- Florida Renters Rights

- Georgia Renters Rights

- Hawaii Renters Rights

- Idaho Renters Rights

- Illinois Renters Rights

- Indiana Renters Rights

- Iowa Renters Rights

- Kansas Renters Rights

- Kentucky Renters Rights

- Louisiana Renters Rights

- Maine Renters Rights

- Maryland Renters Rights

- Massachusetts Renters Rights

- Michigan Renters Rights

- Minnesota Renters Rights

- Mississippi Renters Rights

- Missouri Renters Rights

- Montana Renters Rights

- Nebraska Renters Rights

- Nevada Renters Rights

- New Hampshire Renters Rights

- New Jersey Renters Rights

- New Mexico Renters Rights

- New York Renters Rights

- North Carolina Renters Rights

- North Dakota Renters Rights

- Ohio Renters Rights

- Oklahoma Renters Rights

- Oregon Renters Rights

- Pennsylvania Renters Rights

- Rhode Island Renters Rights

- South Carolina Renters Rights

- South Dakota Renters Rights

- Tennessee Renters Rights

- Texas Renters Rights

- Utah Renters Rights

- Vermont Renters Rights

- Virginia Renters Rights

- Washington Renters Rights

- West Virginia Renters Rights

- Wisconsin Renters Rights

- Wyoming Renters Rights

- Washington, D.C. Renters Rights